IRS alerts 19 million taxpayers about their tax returns

The IRS alerts approximately 19 million taxpayers who requested an extension to file their 2021 taxes.They have until October 17, 2022.

- The IRS alerts approximately 19 million taxpayers who requested an extension to file their taxes.

- They have until October 17, 2022 to file their taxes.

- The IRS has a tip.

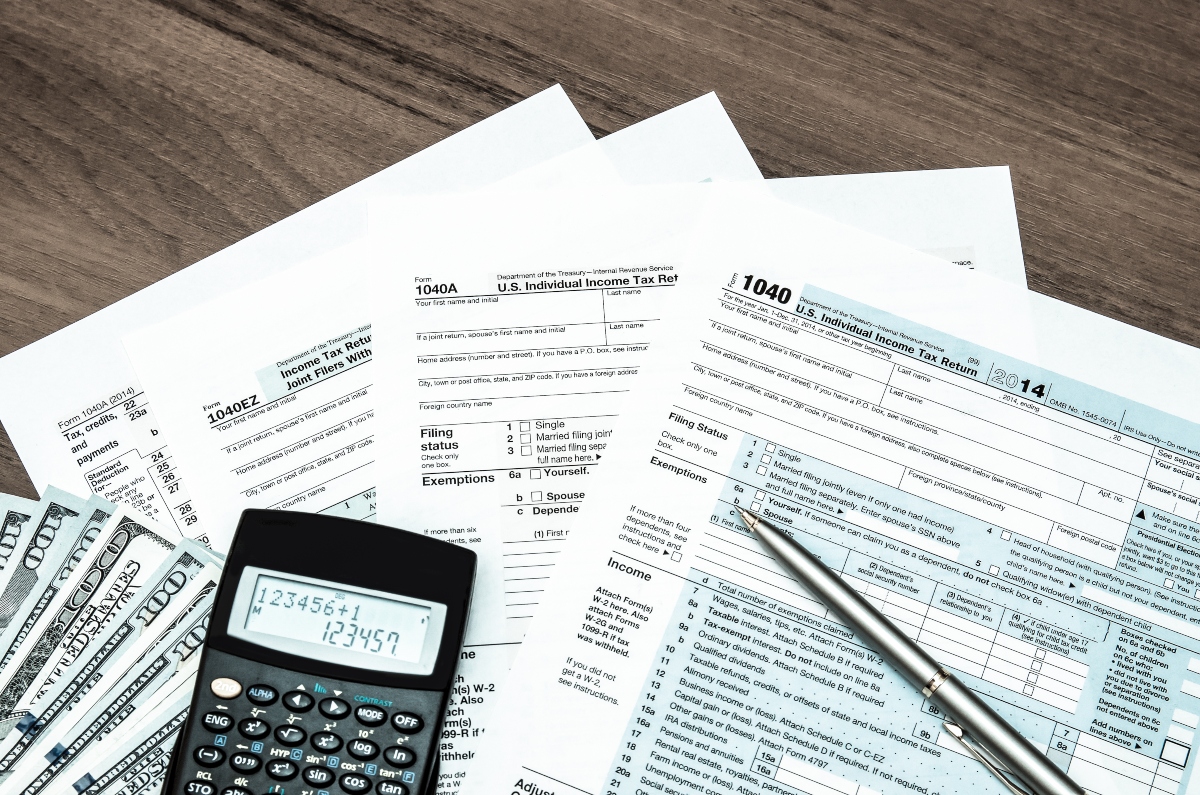

ATTENTION! The Internal Revenue Service (IRS) has put approximately 19 million taxpayers who requested an extension to file their taxes on alert. They tell people not to wait until the last minute to finally file their 2021 tax returns.

The federal agency had set the deadline to file a 2021 tax return in April. However, millions of people requested an extension, which gives them until mid-October to file. Still, the IRS has a tip.

IRS alerts 19 million taxpayers about their tax returns

Advice: DON’T WAIT UNTIL THE LAST MINUTE. Although it is true that the taxpayers who requested an extension have until October 17, 2022 to gather their documentation and present it to the authorities, the best thing you can do is get everything done ahead of time.

“If a taxpayer has all the information needed to file an accurate return, they can file electronically at any time before the October deadline and avoid the last minute rush,“ recommends the IRS on its official website.

IRS recommendations

The recommendation for taxpayers who requested an extension is to finally file their 2021 tax return as soon as possible in order to avoid delays in the processing their information. So if you already have all your documentation at hand, don’t waste any more time.

On the other hand, if you still have doubts, the agency has various ways for you to get advice. You can go to the Frequently Asked Questions section on its website or contact the Interactive Tax Assistant, a tool that will provide answers to your particular tax questions.

A couple of useful tips

The IRS has also offered taxpayers a couple of tips when filing their tax return that will make it quicker to process their returns and receive any refunds.

The agency recommends that individuals or families who have not yet filed their 2021 tax return do it electronically and select direct deposit for their refund. Today, the IRS is able to process electronic returns much faster, and money sent by direct deposit reaches people almost immediately, unlike a check that must travel through mail.

What should I do?

The IRS has also provided a tool, IRS Free File, for eligible taxpayers to prepare and file their federal income tax return for free. Additionally, those who have earned up to $73,000 annually will be able to use IRS Free File Fillable Forms.

“IRS Free File allows you to prepare and file your federal income taxes online through guided tax preparation, on an IRS partner site, or on Free File fillable forms. It’s safe, easy and at no cost to you for a federal return,” the agency explained on its website. FILE FOR FREE HERE.

Related post

Related post